US garden supply industry analysis: An SEO perspective

Recent global issues are likely leading to significant changes in the US garden supplies industry. The rising costs of living and droughts will play a major role in the market over the next couple of years, with significant changes having already occurred in the last five.

So far in 2022, 80% of the western USA experienced severe drought. This has presented tough challenges for the US garden supplies market, which is very much dependent on the climate to be successful.

Equally, there has been an increase of customers growing food at home for personal consumption as a result of an 11.4% increase in food prices alone in 2022. With more people growing food at home, we can expect to see an increased demand for garden supplies that support the production of high-volume, low-cost produce.

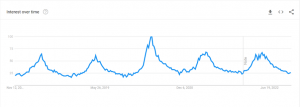

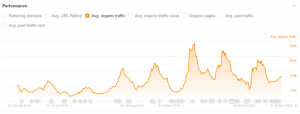

These trends and the drastic shift the global pandemic played in introducing consumers to gardening are influential factors in the financial growth of the nursery and garden stores market to $42.3bn. The pandemic alone caused a 60% growth in the gardening search topic in the US, which coincided with the expected annual peak from March to April. This helped the industry grow a considerable amount.

However, since the 2020 spike in search volume, annual peaks have gradually declined. They are now marginally higher than before the lockdowns, suggesting the market is returning to normal. The pandemic introduced many people to gardening, with a continued interest that is expected to cause long-term market growth.

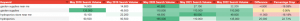

Taking a closer look at organic search trends for parent keywords confirms the spike in 2020. However, it also suggests the increased interest in garden supplies may be sustained. For example, “greenhouse supplies” spiked with a May 2020 search volume of 12.1k during the pandemic then dropped to 8.1k in May 2021. This is a significant decrease in search volume but is still greater than the 6.6k May 2019 organic search volume before the pandemic.

In 2022, search volume for greenhouse supplies continued to increase to 9.9k, indicating interest from the pandemic has continued and the market is growing. This pattern is mirrored across the search terms “garden store near me” and “landscape supplies”, while “garden supplies” reached highs during the pandemic and remained consistent for the next two years.

In 2022, there was a decrease in search volume for the terms “hydroponics store near me” and “garden supplies near me”, which both have local intent. This may be reflective of the unquestionable shift to eCommerce over the past couple of decades.

Looking at the difference in search volume between online and local intent, it’s evident that, for those specific declining terms, their online counterpart grew or maintained a high search volume.

Let’s analyse seven different companies in the garden supply industry and evaluate their search performance.

Aero-Garden

Aero-Garden provides indoor hydroponics to the US and Canadian markets. They offer multiple variations of hydroponics pods based on the required size and plant. Seeds, grow lights and accessories are also available on their website, with products ranging from $99 to $1049.95

Aero-Garden target the luxury end of the market, but also offers up to 40% off. Targeting new gardeners, their marketing focuses on ease of use, lack of maintenance, and offering a germination guarantee.

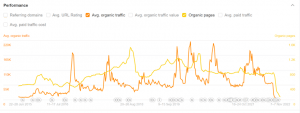

Looking at their organic traffic the annual spike is contrary to the annual spike in the overall market. The graph shows an increase in organic traffic around December. This is likely because it is an indoor product and not reliant on weather, leading to a spike in volume for Christmas instead of summer.

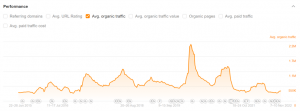

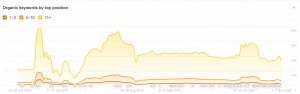

More notable than this is their current performance. After reaching organic traffic highs of 889k their organic traffic is now only 999 per month. This is likely an issue to do with the number of indexed pages on their website and not the market. Looking at the graph above there is a clear drop of both organic traffic and indexed pages in August and September.

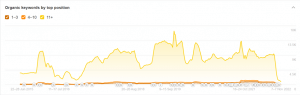

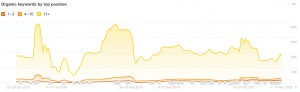

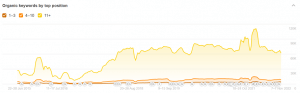

This is mirrored in the keyword rankings on the website. There is nearly a 7k drop in keywords Aero-Garden ranked for, now only ranking for 940 keywords. A significant proportion of these came from the top three rankings positions.

Burpee

Burpee provides a wide range of high-quality seeds or plants, and growing supplies. Prices range from $2 to $300+, and while most of their products are low-priced seeds, they also offer higher-priced items such as wheelbarrows, which broadens their price range. However, most of their traffic comes from seeds, accounting for most of their business.

Burpee boasts an abundance of highly qualified experts to help customers grow successfully and are proudly the first to develop iceberg lettuce. Selling mostly online, they still have a farm used for developing breakthrough varieties.

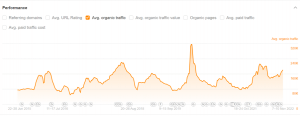

Looking at Burpee’s current organic traffic, it is significantly lower than previous highs. Organic traffic peaked at nearly 2.2 million in the pandemic but is now less than 400k. This matches the expected annual cycle but differs from the year-on-year trend seen in parent keywords mentioned in the introduction, indicating a larger issue.

The number of keyword rankings is quickly declining, losing rankings for nearly 6k keywords and 3k of them coming from the top three positions.

More recently, there has been an increase in traffic but a decrease in traffic value. This is likely because of a slight increase in rankings since the quality content update was implemented.

Plowhearth

Founded in 1980, Plowhearth quickly became one of the fastest growing retail stores in the US. They expanded through mail-order catalogs then became one of the fastest growing eCommerce stores in 1998.

Plowhearth offers a range of products, including outdoor and indoor furniture, decorations, and supplies. Garden supplies only make up a subsection of their sales because a significant amount of traffic still comes from non-garden related product categories. This allows Plowhearth to target a much broader audience than other garden supply specialist competitors.

Looking at Plowhearth’s organic traffic, it seems very sporadic in the short term while declining over time. Using third-party data, we are unable to get access to data from 1998, so it’s not possible to see its original traffic growth. However, what is notable is the pandemic spike, which failed to create an organic traffic high, unlike most competitors.

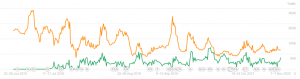

Digging deeper into why organic traffic is so sporadic, we can see there is a high correlation between paid media and organic traffic. This started in 2016 when organic traffic started to dramatically decline. Introducing paid media may have been an attempt to supplement the loss of organic traffic at that point in time. As organic traffic has continued to decline, paid media has become more heavily relied on.

Looking at page rankings, it appears there were a few instances when Google algorithm updates had a significant effect on organic traffic. These continually negatively affected rankings so their gradual loss of organic traffic may be due to not staying up to date with the algorithm.

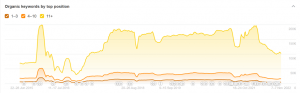

Google introduced RankBrain in 2015 and started indexing HTTPS pages by default. This was followed by a drop in organic traffic from 367k to 172k in the space of two months. As a result, Plowhearth lost 11+ rankings for 124k keywords, 15k 4-10 ranking keywords, and more than 4k keywords for positions 1-3. Similar incidences took place in March 2018 and November 2021.

Parkseed

Founded more than 150 years ago by a 15 year old boy, Parkseed now sells more than 1,100 mail-order plants and seeds. Parkseed primarily focuses on seeds but also sells growing supplies, and solely targets the US and Canadian markets.

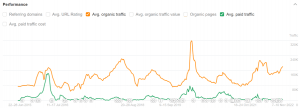

Reaching organic traffic highs of 320k in the pandemic, Parkseed now gets 180k in organic traffic. This is an increase from 90k in November 2021, following the market trend identified earlier. Continued market growth of the industry causing the spikes during lockdowns helped interest new market participants and aid long-term market growth.

Parkseed is seeing consistent short-term growth. Keyword rankings continue to increase, a healthy sign considering most competitors’ recent decline in performance. Keyword rankings increased by nearly 9k, 1.5k of them being top three ranking positions while organic traffic increased by more than 90k.

Similar to competitors, Parkseed has also tested a paid media strategy. There has been a significant correlation with organic traffic when paid marketing has been used, but it has only been used a few times. Now that paid traffic has been cut out completely and organic traffic is continuing to increase, it can be assumed that Parkseed has shifted their focus to SEO.

Greenhouse Megastore

Founded in 1993, Greenhouse Megastore is a US-based greenhouse supplies store that solely targets the US. They operate in two locations and online, offering supplies ranging from greenhouse frames to heating equipment. Their strategic focus is providing affordable prices for and offering unconditional one-year guarantees on all their products.

Looking at Greenhouse Megastore’s organic traffic, there is a significant decrease after a series of three core updates in April 2018. However, this was fixed, and the website grew steadily until the pandemic, which had a negative impact on organic traffic.

Since the pandemic, organic traffic has continued to decline to its lowest point since 2019. This is accompanied by a dip in keyword rankings, so may be a sign of a wider issue and not the market’s annual cycle. An explanation of this could be Google’s new algorithm update, the quality content update that was implemented in August 2022. The drop is equivalent to over 15k in ranking keywords and 20k in traffic, so even though it doesn’t look significant on the graph, it is a considerable drop.

If there is a drop in organic traffic without a drop in rankings, it’s safe to assume it’s an issue with the market. A notable trend among competitors is the significant spike and drop in ranking keywords in 2015. This could be caused by the three Google updates that were released at the time — RankBrain, introducing HTTPS as the default, and a core Google update focused on E-A-T.

Monster Gardens

Monsters Gardens is an eCommerce store based in California. They boast the largest selection of hydroponics in the US and deliver to the US only. Monster Gardens occupy a completely unique brand position, offering an edgy alternative to conservative gardening brands. Their content library is presented under the name Monster U and offers farmer sleaves with tattoo designs.

Looking at third-party data, a significant drop in March 2019 overshadows the rest of the data. This can be explained by a significant decrease in keyword rankings from a core Google algorithm update focused on E-A-T.

The data implies Monster Gardens took action’s to recover from this and have gradually returned to new organic traffic highs. They remain mostly unaffected by the pandemic spike (which affected most of their competitors), probably because their product range focusses’ on hydroponics. As detailed in the introduction covering market trends, we can see hydroponics seasonal trends vary from those of traditional gardening supply companies. This suggests the hydroponics market segment needs to be treated differently from the rest of the market.

More recently, there has been a decrease in total keyword rankings but an increase in traffic. This could be due to the quality content algorithm update that negatively affected competitors. By looking at the increase in top three keyword rankings (+149) we can infer this is the case. 11+ ranking keywords have decreased, meaning some of those rankings have increased from positions greater than 11 to the top three, rewarding Monster Gardens for having higher quality content.

Gurney’s

Founded in 1866 by a Lieutenant Colonel during the civil war, Gurney’s focusses on offering a large range of mail-order seeds and plants. After passing, his seven sons took over the business and grew it into one of the largest seed houses in the world. Now, operating solely online, they deliver to every US state except Hawaii and Alaska.

Gurney’s web presence has grown to become a significant driver of traffic. It follows the annual trend of peaking in March and dropping in December. Similar to competitors, Gurney’s experienced a significant boost from the pandemic, with organic traffic peaking just below 340k.

Like Monster Gardens, Gurney’s also seems to have benefited from the quality content algorithm. Seeing a decrease in total keywords but increasing in top three keywords, leading to a 40k traffic increase.

However, Gurney’s doesn’t follow the expected market growth. Instead, its year-on-year organic traffic is slowly decreasing. This is likely an issue with the website. Even though the top three keywords have recently increased, it is still a large decrease from February 2021 when keyword rankings decreased from 111k.

This is all particularly unusual given that referring domains have continually increased, suggesting an increase in website authority. Looking at algorithm updates around that time, we can see that there was a page experience update which may have caused the decline.

Conclusion

There have been a few key influences on the industry. The first is seasonal trends — this is a key driver of traffic but doesn’t affect all companies. Hydroponics seems unaffected, as the seasonal spike is much less significant and happens in December for Christmas. Expanding in hydroponics may be a good way for companies to diversify and create more consistent revenue.

Secondly, the pandemic caused a significant spike for most, but search volumes returned to levels similar to before lockdowns. Traffic for most companies doesn’t follow the overall market trend, suggesting the keyword long tail is responsible for a lot of traffic.

Finally, the quality content algorithm update is having significant effects on rankings. Companies that saw significant traffic improvements often lost total keyword rankings but gained top three rankings.

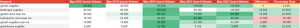

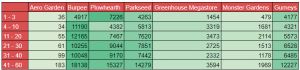

Using third-party data we can compare rankings across a variety of ranking positions. Below is a table detailing the results.

High performers

Plowhearth are clear front runners in top three keyword rankings, but they offer a much broader range of products, much of which sits outside the garden supply industry. Parkseed, Gurney’s and Burpee have a very similar amount of top three keyword rankings, but Burpee dominate the lower rankings. For positions 4-10 Burpee have 11k ranking positions compared to Gurney’s 4.3k and Parkseed’s 5.8k.

Low performers

AeroGarden are currently performing the worse. This is clearly apparent in the table above, and is due to a very recent decline in performance. They were ranking for more than 9.4k keywords. AeroGarden might be able to recover from this dramatic decrease in performance because they clearly have the ability to generate lots of organic traffic.

Both Greenhouse Megastore and Monster Gardens have a relatively low quantity of ranking positions compared to the four front runners, although Greenhouse Megastore outperforms Monster Gardens by quite a lot.