Industry analysis – US golf eCommerce

With most sports, you often find the player blaming their equipment for poor performance, which fuels them to overhaul their kit instead of finding the root cause of what’s wrong.

The way people buy golfing products such as power caddies and irons has considerably changed over the years in the US. They’re no longer heavily relying on visiting the local shop at their golf course or American Golf, but are instead choosing to shop online.

Like with any sporting item, the customer completes a research phase to find the best product to meet their needs and wants. They may then hire the item if it’s available before making their purchase.

This new type of user journey was further solidified by the pandemic when non-essential shops closed while golf courses stayed open, highlighting the importance of having an online presence.

Let’s take a look at who is excelling in the US eCommerce golf market and who’s not doing as well from an organic perspective. Typically speaking, these websites sell a wide range of golfing goods from apparel, clubs and golf balls.

The six eCommerce golf websites we evaluated are:

Organic search visibility overview

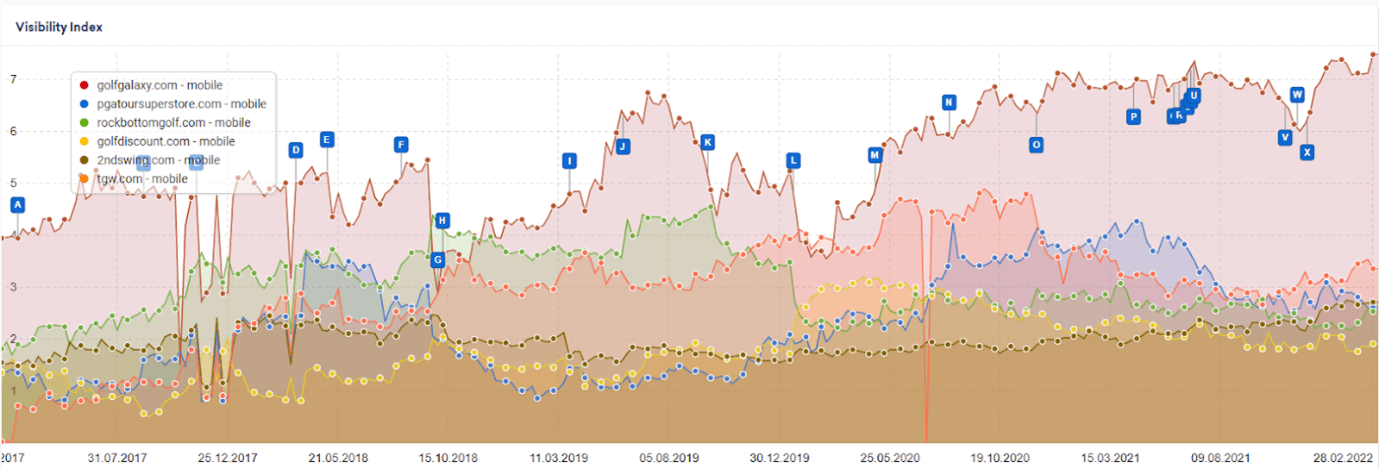

Using third-party organic visibility data from Sistrix for the past five years, we have been able to compare six leading online golf retailers.

All six of the golfing companies we have analysed were within Google’s index since 2017. However, TGW was established slightly later in March 2017. Over the five-year period, we can see Golf Galaxy has dominated the US eCommerce golf market.

Both Rock Bottom Golf and TGW have tried to give Golf Galaxy a run for their money, however neither have been successful. Golf Galaxy has gradually grown their organic performance while recovering from Google’s algorithm updates relatively quickly.

During the five year period, Google released over 20 algorithm updates, such as the medic update and standard core algorithm updates. This has resulted in some site benefits like Golf Discounts organic market share increases following Google’s release of their January 2020 Core Update. In contrast, some of the identified sites were not as lucky, including TWG, who were negatively impacted by Google’s December 2020 core update.

Organic winner

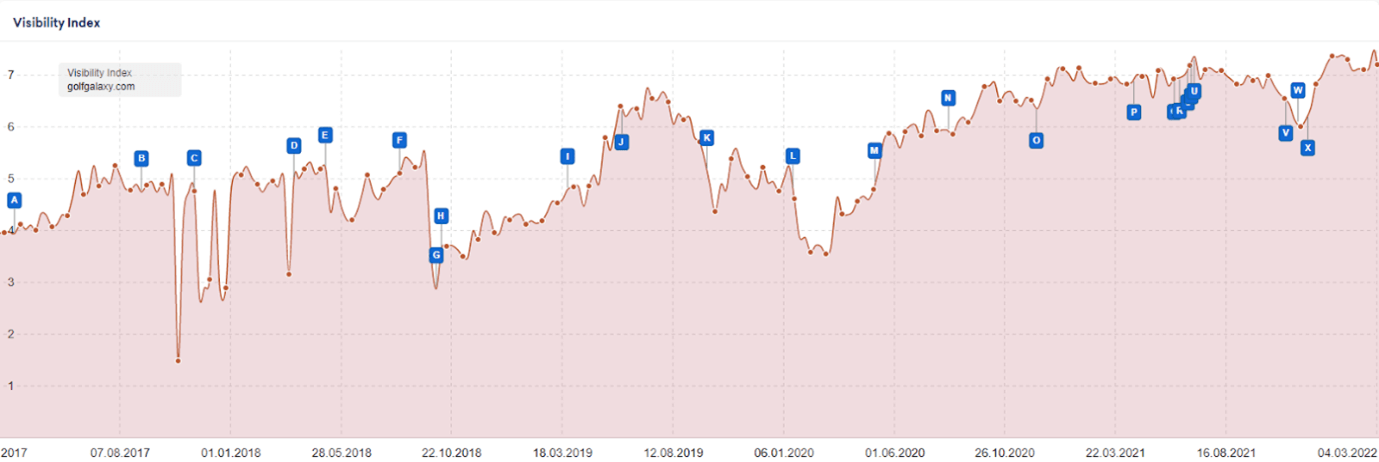

There has been multiple winners in the US golf eCommerce market, from Rock Bottom Golf to TGW. However, the most prominent since September 2017 is Golf Galaxy.

Golf Galaxy has been extremely successful organically for a number of reasons, from product page optimisation to supporting content with internal links pointing back to the commercial product pages.

All the tactics used by Golf Galaxy have significantly increased their organic keyword footprint by approximately 1153% over the 5 years targeting a range of broad and niche commercial and non-commercial terms, for example TaylorMade SIM2 Driver Review.

During Golf Galaxy’s reign, we can see that the golf eCommerce company was positively and negatively impacted by Google’s algorithm updates. For example Golf Galaxy’s organic market share increased following the December 2021 product reviews update. On the other hand we are able to see that Golf Galaxy was impacted quite heavily during the medic #1 and #2 update, but the site bounced back relatively quick.

Overall, Golf Galaxy have created and implemented a well thought out and highly successful organic strategy over the past five years.

US eCommerce low-hitters

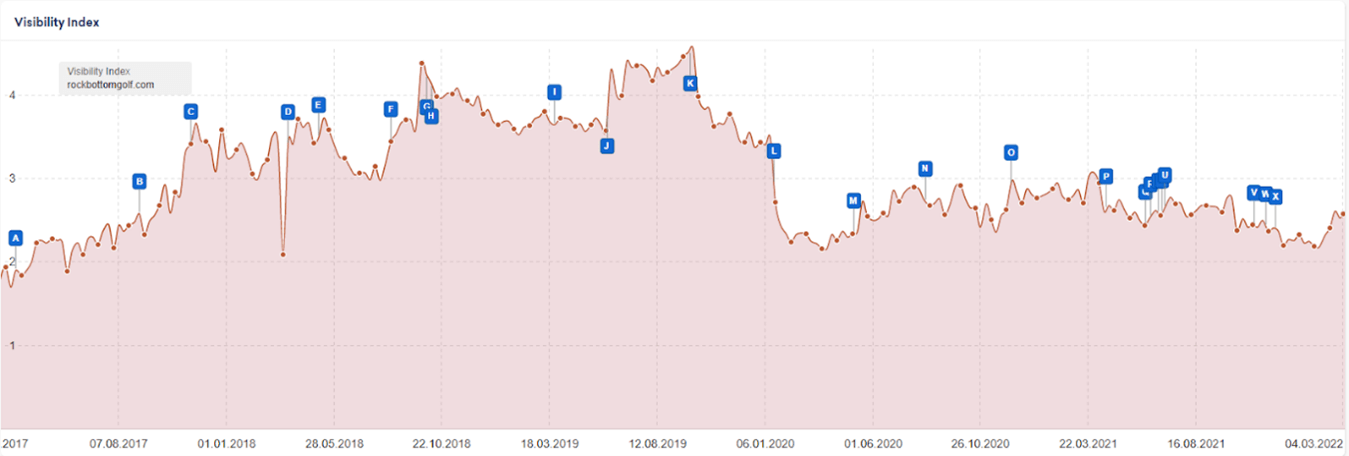

In 2019, Rock Bottom Golf was hit by Google’s September Core Algorithm Update, causing the eCommerce golf site organic visibility to gradually drop for five months. Typically when we see a site continuously drop month after month before stabilizing, it may suggest there were issues with the site quality. This could be because of a large proportion of poor backlinks or keyword-stuffed content.

The purpose of Google’s Core Updates is to continuously improve the quality of search results displayed to users and provide a better experience, which is why EAT is increasingly important for the six site’s we have analyzed.

Unfortunately, Rock Bottom Golf was negatively impacted by another of Google’s Core Algorithm Updates in January 2020 ,which increases speculation that the site wasn’t following SEO best practices.

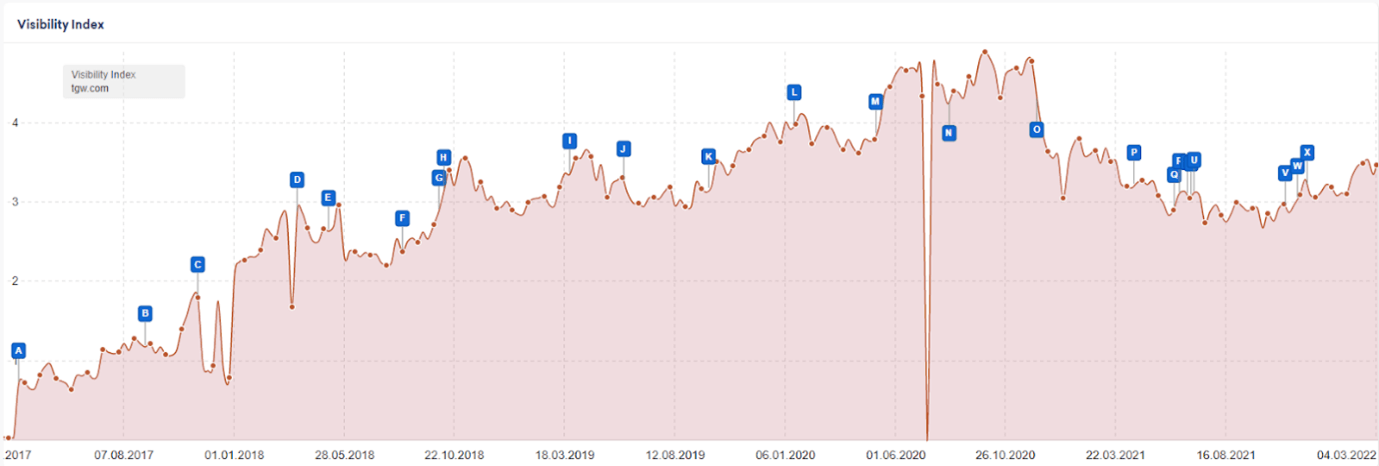

During the five years we analysed, we were able to see that TGW was another site where organic performance was negatively affected more recently.

Up until December 2020 this eCommerce golfing site’s organic performance was continuously increasing. However, they were hit by Google’s Core Algorithm Updates in December 2020, which caused this site’s organic market share to gradually drop over ten months before stabilizing again. This update was thought to have impacted eCommerce sites the most.

Upon inspection we can see the TGW site doesn’t utilize product-structured data on product pages. They currently only contain breadcrumb list markup, which could have contributed to a drop in organic market share.

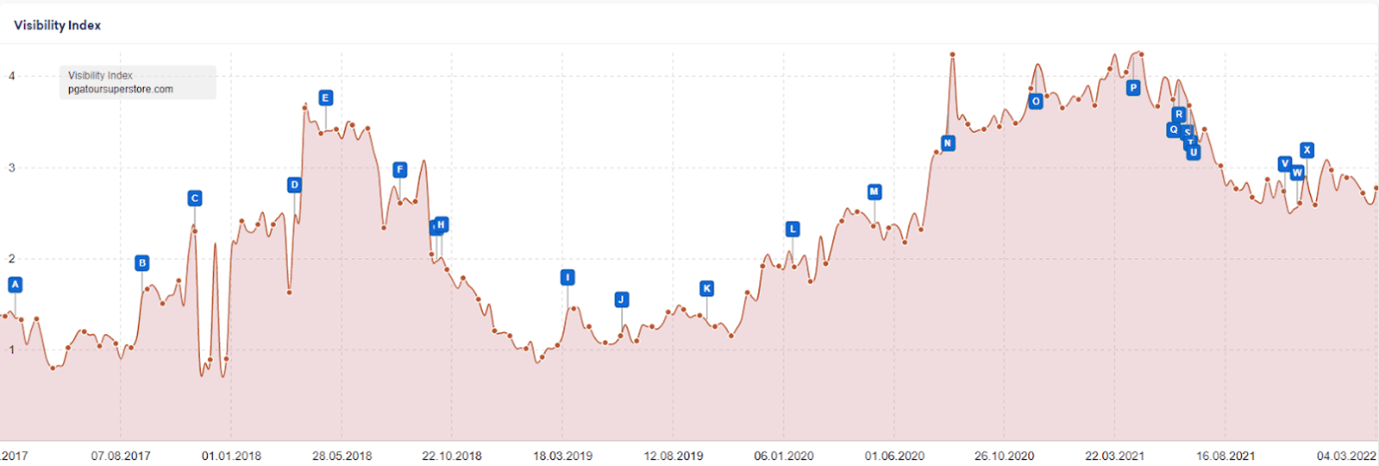

Out of the six US eCommerce golfing sites we have reviewed, we can see that PGA Tour Superstore was hit by the second rollout of Google’s Medic update in 2018, which resulted in organic visibility dropping for several months before settling again in February 2019. This update looks to have hit nearly five of the six eCommerce sites we analysed.

It’s thought that this algorithm update was focused on better matching intent and for the most part impacted YMYL (Your Money, Your Life) websites as Google holds these types of sites to a higher standard.

Off the back of the medic update, PGA Tour Superstore spent the next two years trying to recover their lost organic market share, which was impacted again when Google rolled out their Page Experience Update in June 2021. This mobile core web vital update was released over a couple of months before finishing in August 2021. Core web vitals are a part of Google’s wider page experience update, which includes the likes of mobile-friendly and https.

We are able to see that PGA Tour Superstore website appears to be on Salesforce and page speed/ core web vitals are a common platform flaw. PGA Tour Superstore should consider the following to improve their page experience:

- Reduce unused JavaScript

- Defer offscreen images

- Reduce unused CSS

- Eliminate render-blocking resources

- Serve images in next-gen formats

- Enable text compression

The US golf eCommerce market has grown a lot over the past five years, and Golf Galaxy is excelling with a massive lead and currently no indication of the other major sites closing the gap.

Unfortunately, Rock Bottom Golf, TGW, and PGA Tour Superstore were negatively impacted during the recent years. A good way for these companies to grow their organic presence would be increasing their keyword footprint. This could be achieved by selling new product ranges or targeting non-commercial keywords to provide informational content for products which, can then be internally linked directly to products.

It’s always important to gain an understanding of why a site was hit by a core update, reducing the likelihood of this occurring again.