Who’s dominating the US meal subscription box market?

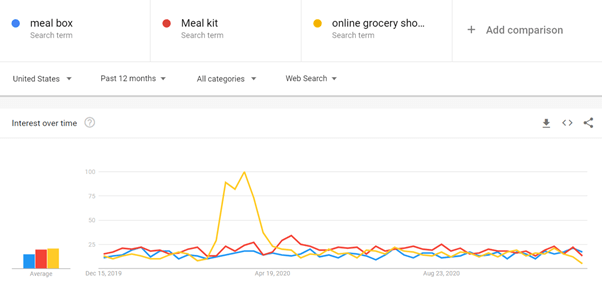

2020 was a year that changed many consumer habits; from personal training being delivered over video calls, to pubs only providing a takeaway service.

The food and hospitality industry has been significantly impacted by the COVID-19 pandemic, resulting in significant changes in consumer behaviour. For instance, many people no longer visit supermarkets over the fear of catching the virus and have turned to ordering their groceries online.

For some, this change has been in the form of purchasing meal subscription boxes, and many businesses have moved online to capitalise from this new demand. If you’re an online grocery business, a successful organic strategy is paramount to ensure you’re at the forefront of your target market, especially in the new year, when people often begin with a health kick.

The meal subscription box industry is highly competitive, particularly in the US, as customers often move across competitors. However, this article will explore the winners and losers of the meal kit subscription market from an organic search perspective.

An overview of the current US meal box marketplace

For this market analysis, we have focused on six of America’s leading online meal box subscriptions over the past five years, to highlight those that have increased organic performance year-on-year compared to those in decline. To do this, we have used various third-party tools to collate data to assist our insights.

The six websites we analysed are:

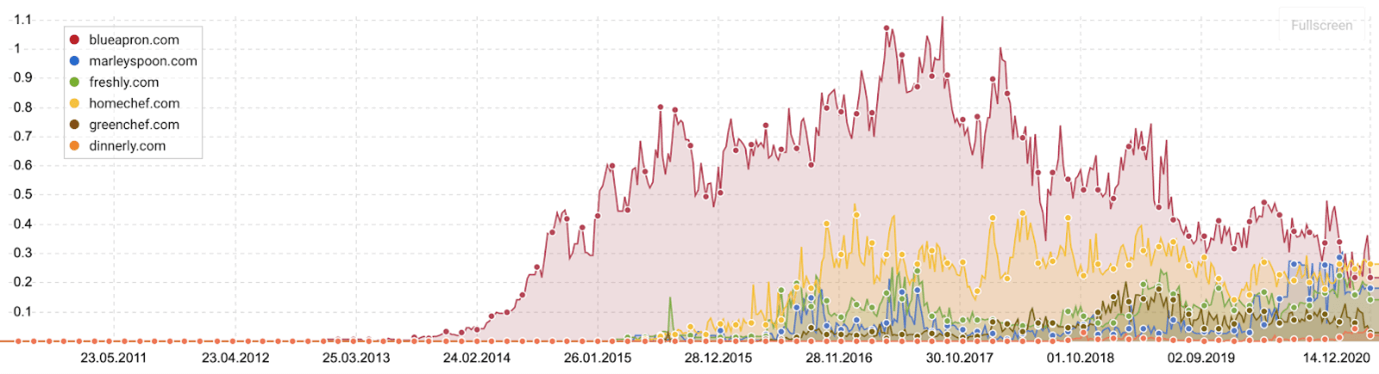

Organic Visibility Overview

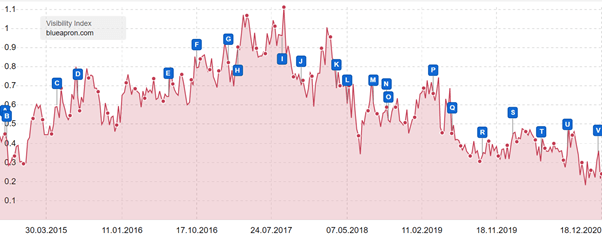

When comparing the organic visibility from 2015 to 2020 for all six US meal subscription websites listed above, it’s clear that Blue Apron had a head start compared to their competitors. This gave the company the chance to accelerate its marketing strategy to enable it to capture a greater market share to become the industry leaders.

This strategy proved successful up until late 2017, whereby its market share started to decline, due to being negative impacts by Google’s algorithm updates. As the graph shows, Blue Apron’s website was continuously impacted by Google’s algorithms, which has resulted in Home Chef, Marley Spoon, and Freshly, earning a big share of the market, especially in 2020.

As of 2020, the meal subscription box market has become increasingly competitive, with Blue Apron, Home Chef, Freshly & Marley Spoon all battling for the top keyword positions such as “meal kit”, “meal delivery” and “fresh food delivery”.

Home Chef and Marley Spoon started seeing organic visibility increases around the same time. Still, Home Chef’s organic strategy appears to have had a greater positive impact when comparing the two. This advantage is likely due to Home Chef’s visibility being significantly higher from 2015, right up until the start of 2020.

Since January 2020, Marley Spoon’s organic visibility had almost tripled by May, and then at the start of August, the brand was briefly the industry leader. However, on 28 August, the company’s organic visibility suddenly dropped, below numerous competitors. This occurred simultaneously to Google’s infamous search bug, which suggests the site may have been affected by this indexing glitch.

The six websites’ organic visibility data has been a great way to highlight the changing market share over the past five years. From Blue Aprons having 99% visibility in early 2015, to now only having 25% in December 2020, we can see that this is a volatile and aggressive market.

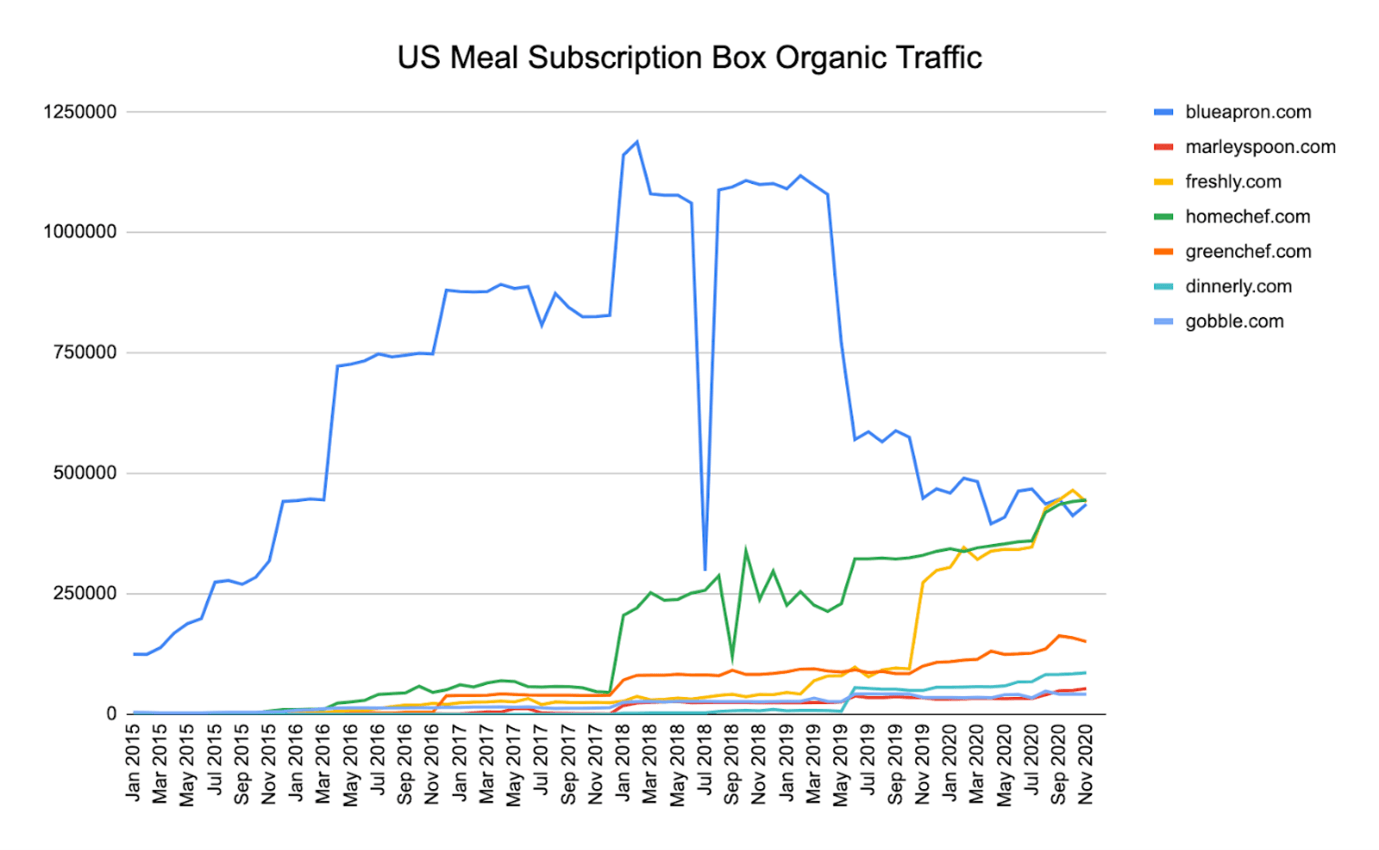

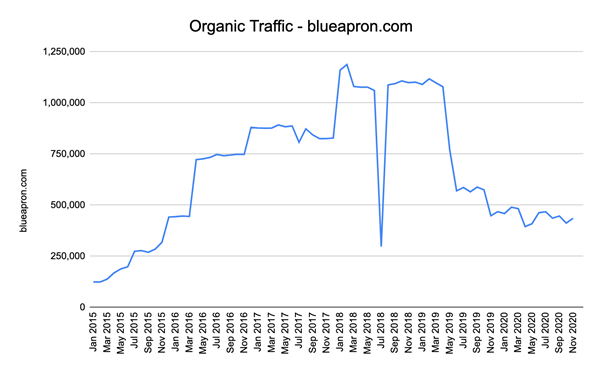

Organic Traffic Overview

Using a third-party tool, we captured each of the six websites’ organic traffic.

Based on the graph displayed above, it’s interesting to see such a significant drop in Blue Apron sessions. The site was far ahead of its competitors, only for Freshly and Homechef to now receive the same, if not slightly more organic traffic each month.

Something has gone seriously wrong for Blue Apron to lose nearly half a million organic sessions. February 2019 was the company’s best month earning 1,118,105 sessions, but five months later, its organic traffic dropped to 570,392 sessions in June 2019. Due to this drop, it’s taking Blue Apron’s performance back to early 2016.

Blue Aprons Organic Performance

Upon closer inspection, we can see that Blue Apron was negatively impacted by the August 2017 update (Label I), the March 2018 and May 2018 Core Updates (Labels K&L), as well as the March and June 2019 Core Updates (Label P & Q). As we can see, due to the continuous negative impact to search from the algorithm updates, organic visibility has declined over three consecutive years.

As Blue Apron has seen a negative impact from Google’s Core Updates in 2018 and 2019, this would suggest that the website isn’t being recognised as having high-quality or valuable content and or backlinks. Therefore, each time Google releases a core update, it has resulted in Blue Apron’s websites being discredited.

Google uses this type of algorithm update to reward high-quality websites that comply with Google’s guidelines, by boosting keyword positions, resulting in the website being displayed on the search engine results page for more relevant queries.

A potential reason why Blue Aprons’ organic performance has drastically dropped is because of a poor page speed score, which could cause poor user experiences and make it harder for bots to crawl and index.

When carrying out a handful of page speed tests, the average score is 6/100. This is exceptionally poor, but there are several quick fixes that could improve Blue Apron’s page speed, such as removing any unnecessary third-party code and removing all unused CSS/Javascript.

This issue will need to be addressed, alongside a “Largest Contentful Paint” issue. This is caused by the hero image text node, and results in an average LCP score of 13.5s. Ideally, this should be resolved before Google’s Page Experience Algorithm Update is rolled out in May.

Additionally, it looks as though Blue Apron’s website may have difficulty rendering JavaScript. This should be resolved if Blue Apron moves to server-side rendering.

Upon further investigation, we found some additional issue from JavaScript execution time taking too long to preload requests. JavaScript execution time can be reduced by removing any unused or unnecessary code and minifying and compressing other areas of code.

In contrast, preload requests can be improved by adding a small snippet of code using <link rel=preload>to the sites <head> section specifying which critical request to preload.

All three issues mentioned above can harm organic visibility and traffic, as Google crawls a website in phases. As Blue Apron’s site has page speed, core web vital, and JavaScript rendering problems, it requires Google to use more resources than necessary. This can result in parts of Blue Apron’s website not being crawled regularly or even at all.

When comparing the two data sets, it’s clear that Blue Aprons’ organic visibility and organic traffic significantly dropped in the summers months of 2019, which shows the importance complying with search engine guidelines to prevent performance loss through algorithm updates.

When reviewing the keyword rankings in February 2018, the site lost 74,950 keywords from ranking within the top 100 results, which Blue Apron never recovered. This could be because the site potentially decided to pivot its SEO strategy to deoptimise certain keywords. However, it’s also highly unlikely for such a large number of keywords to drop intentionally. Despite this, the site’s organic traffic remained relatively stable until April 2019.

In May 2019, Blue Apron’s organic traffic depleted by almost half of April’s traffic. This may have resulted from the March 2019 Core Algorithm Update as 17,000 keywords appear to drop out of the search results from March to August.

The purpose of Google’s Core Updates is to continuously improve the quality of search results presented to users, to provide a better experience. As a result, these changes can negatively impact websites like Blue Apron, which may not meet Google’s criteria.

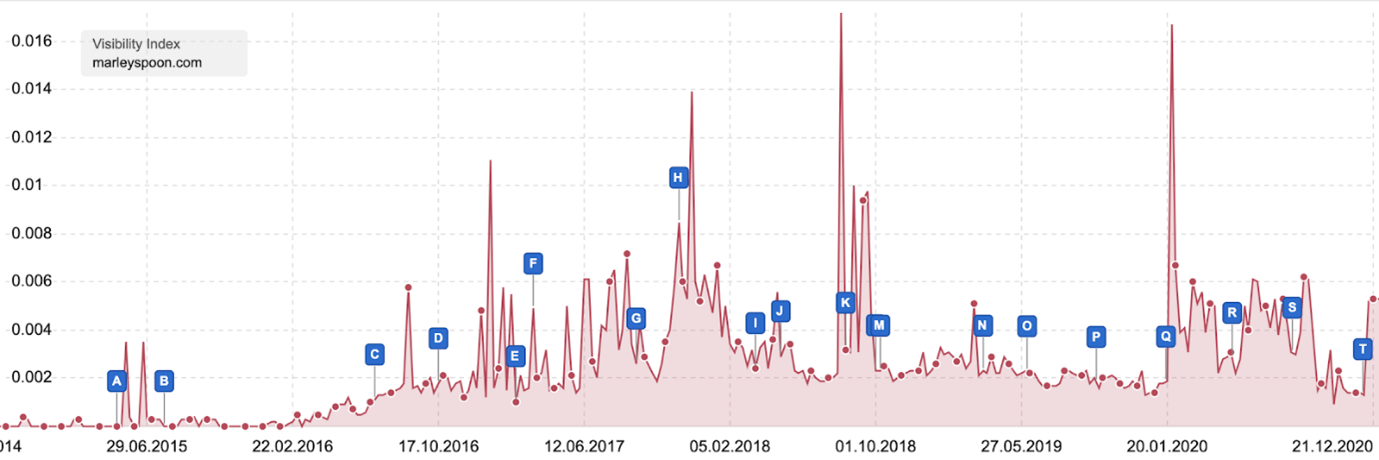

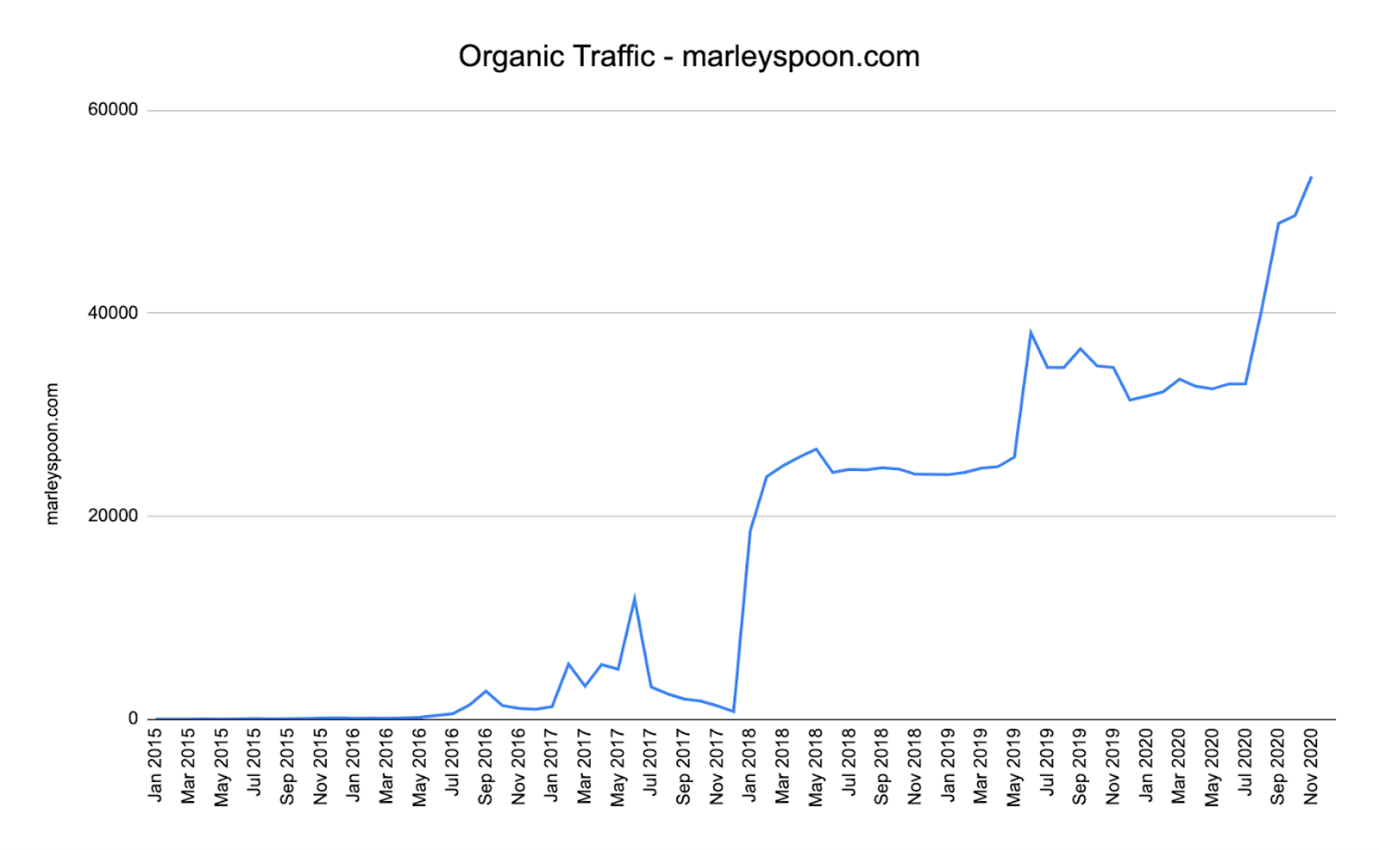

Marley Spoon Organic Performance

Marley Spoon’s organic visibility has steadily grown over the past five years, the graph above shows that around the time of a core update, Marley Spoon’s ranking becomes erratic. This behaviour is emphasised when Google’s Medic Update was rolled out (Label K), and the January 2020 Core Update (Label Q).

Overall, it looks as though Marley Spoon has rarely felt the negative impact of a Google algorithm updates over the past five years. The November 2017 update (Label H) saw Marley Spoon’s organic visibility gradually decline before steadying again in March 2018.

Along with the August 2020 search bug (Label S), the result of a Google glitch, the site was subject to vast amounts of volatility within the SERPs. Although, this issue affected sites en-mass.

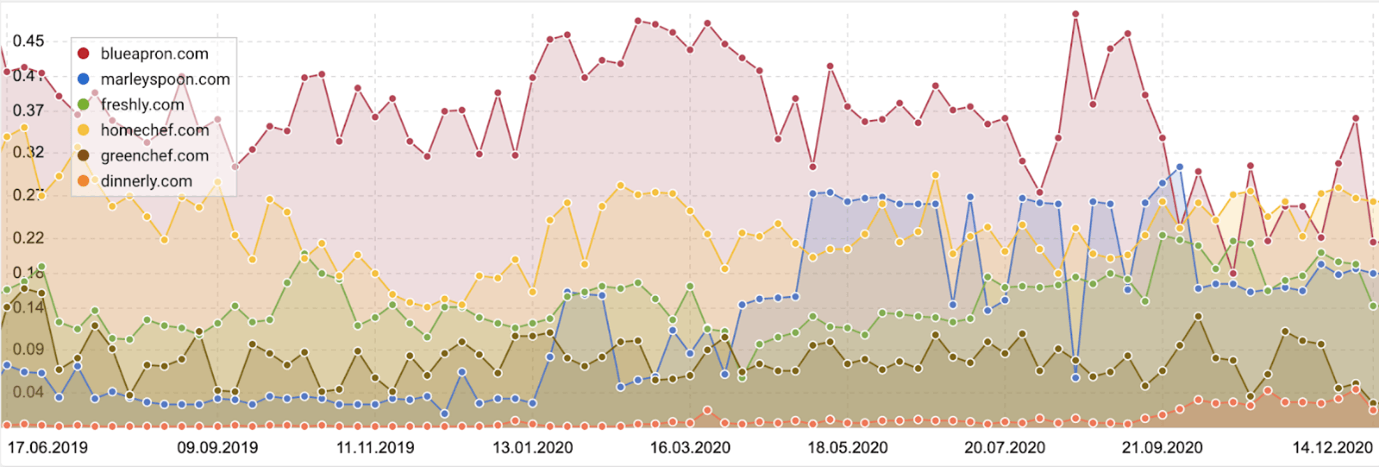

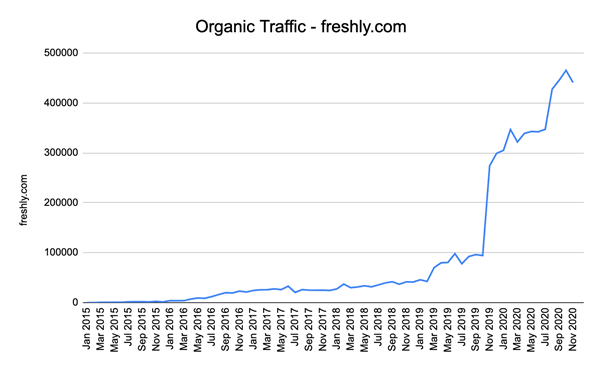

Despite Marley Spoon’s organic visibility gradually increasing over the years, the site’s organic traffic looks completely different.

Our data looks as though the site used a paid and organic search strategy for the first couple of years. The data then suggests that Marley Spoon pivoted its search strategy to solely focus on organic search, which is why its growth is much slower than competitors, such as Home Chef.

The business has significantly increased the number of keywords it ranks for in the last year, going from just over 6,000 keywords in September 2019, to over 35,000 keywords ranking in November 2020. This correlated with the organic traffic increase from summer 2019.

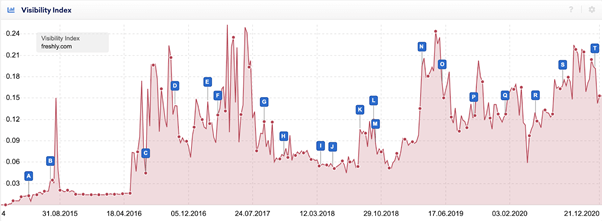

Freshly Organic Performance

In the past year, Freshly has experienced substantial organic search growth, gaining greater organic visibility and an increase in the number of keywords ranking.

Overall, the brand ranks for around 19,000 keywords, which is less than some of the competitors. However, 1,500 of those keywords are in the top three positions. As a result, when comparing Freshly’s visibility to the five other competitors, the company is slightly behind Blue Apron, Marley Spoon & Home Chef.

Over the past five years, Freshly’s organic visibility has had lots of peaks and troughs, due to a fluctuation of its keywords. This is heightened around the time of Google’s algorithm updates. In 2018, Freshly lost around 4,000 ranking keywords, this can be seen on the graph where visibility almost plateaus.

Based on the data, it looks as though Freshly was negatively impacted in October 2016 by the Penguin 4.0 Update (Label D). Like Google Core Updates, the purpose of the Penguin update was to improve the quality of the search engine results by essentially rewarding high-quality websites and discrediting websites that are spammy or provided unvalued content.

Freshly was also hit by the second rollout of Google’s Medic update in 2018 (Label M), which resulted in organic visibility dropping and around a thousand keywords no longer ranking, before experiencing a steep increase again five months later.

Despite Freshly’s organic visibility being lower compared to its competitors, their organic traffic has put them in the running to be the US meal subscription box market leader taking the long-standing title for Blue Apron based on the data collected from a third-party tool.

Freshly currently has just over 2,000 keywords ranking in the top 3 positions, which is almost identical to Home Chef. Whereas Blue Apron has an additional 1,500 keywords in positions 1-3, as a result of this Freshly may benefit from creating and implementing a content strategy of supporting content to sit on the main freshly domain.

By doing this it’ll likely attract more organic traffic which could also lead to an increase in additional users purchasing meal plans to allow Freshly to capture a greater share of the market.

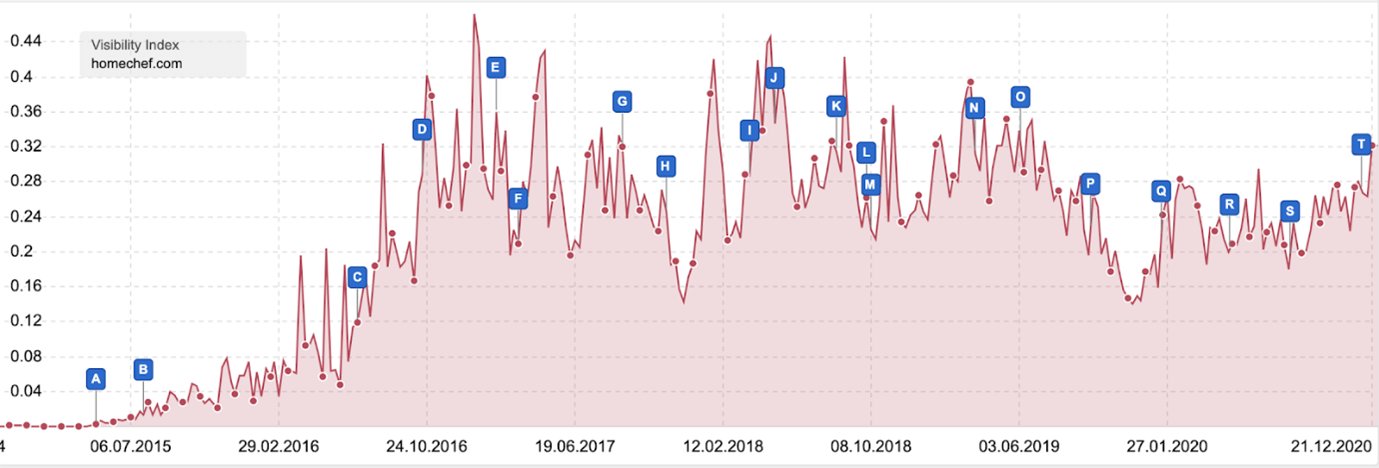

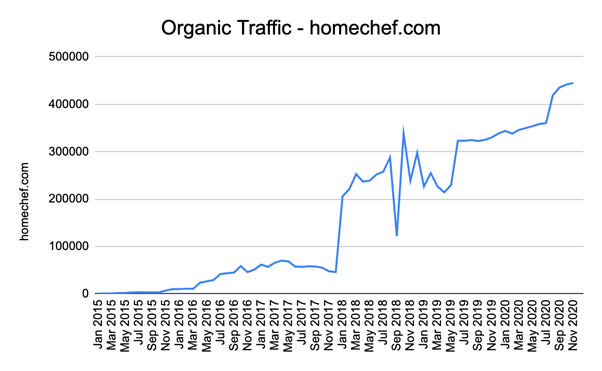

Home Chef Organic Performance

Based on the graph shown above, Home Chef organic visibility increased steadily from 2015 to the start of 2017. Similarly to Freshly, Home Chef was impacted by the Penguin 4.0 Update in October 2016 (Label D), however, the site recovered relatively quickly.

Since the Penguin update, Home Chef saw natural fluctuations in organic visibility, as keywords rankings fluctuated until the June 2019 Core Update (Label O), whereby visibility gradually declined. Google then released the September 2019 Core Update (Label P), which negatively impacted Home Chef until December 2019.

Since then, there have been several updates, and Home Chef’s visibility has remained steady. This could suggest the company has focused on improving the overall quality of the website.

When comparing Home Chefs organic visibility to its organic traffic, we can see that there’s a strong correlation between its visibility dropping and a decline in the organic traffic for the same period.

In 2019, Home Chef was hit by the June and September Google Core Updates, causing organic visibility to gradually drop for six months. However, when comparing this data to Home Chef’s organic traffic, we can see that throughout 2019, traffic was on a slow incline with very little signs of dropping.

This could be due to overhauling metadata and optimising content, or the results of removing and redirecting low-quality pages. It is safe to assume this, as traffic was not impacted by the drop in visibility, along with Home Chef not being negatively affected by 2020 core updates.

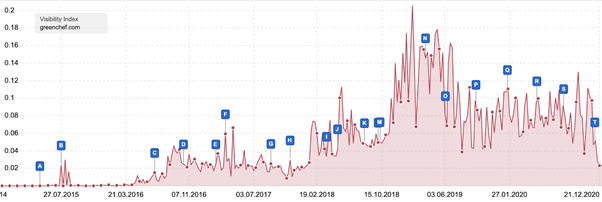

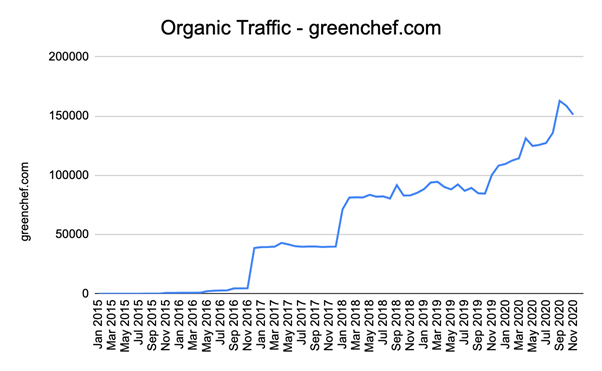

Green Chef Organic Performance

Up until 2019, Green Chef’s organic visibility was steadily growing, with very little signs that any of Google’s algorithm updates had severely impacted the website.

We can see that around the time Google released the second Medic update (Label M), in October 2018, the Green Chef’s visibility was on a steep incline, continuing to grow for four months — before suddenly dropping.

This drop occurred around 4 February 2019, with it taking a month for the visibility to return just before Google released its March 2019 Core Update (Label N). This caused keywords to fluctuate, as SERPs often become more volatile around the time of a Google update.

However, it looks as though keywords and rankings were unable to settle in time before Google released its June 2019 Core Update (Label O), which then led to Green Chef’s visibility slowly declining despite occasional massive spikes.

Following these core updates, the site was also hit by the September 2019, January 2020, and December 2020 Core Updates (Labels P, Q, T), with the latter having the worst effect.

Based on the continued effect of the updates, Green Chef may benefit from reviewing its content and backlinks to ensure that they are of quality, to prevent further updates from impacting the site in 2021.

Like Marley Spoon, Green Chef started receiving organic traffic in June 2015, but it took almost a year until Green Chef gained over 1,000-month sessions in May 2016. However, after a slow start in 2015 and 2016, Green Chef hit over 38,000 organic sessions in December 2016, making it the site’s best month since starting.

Throughout 2017, traffic remained around 38,000-42,000 before a massive jump in organic traffic in January 2018, whereby Green Chef hit just over 71,000 sessions that month. Green Chef’s organic traffic continued to grow at a much slower rate throughout 2018, but in March 2019, the site achieved just over 94,000 sessions, but for the next seven months, the company’s organic session was on a gradual decline which can be seen on the graph.

As Green Chef’s organic traffic declined in April 2019 to October 2019, and lost over 3,000 keyword rankings in the top 100, with 60 out of 400 keywords falling out of the top three ranking positions.

Green Chef was negatively impacted by three core algorithm updates. Therefore, due to Green Chef’s site not complying to Google’s guidelines, it’s highly likely that the negative impact also had a knock-on effect, causing a drop in keywords ranking.

As Green Chef is ranking for fewer organic search terms, it will result in less search engine results.

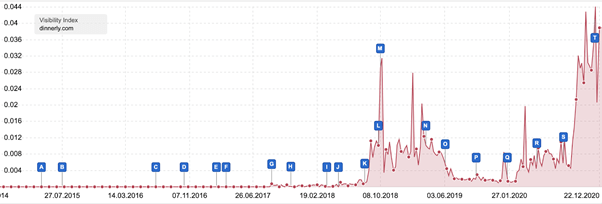

Dinnerly Organic Performance

Dinnerly’s organic visibility has quickly grown over the past two years, the graph above shows that around the time Google releases an algorithm update, Dinnerly’s rankings become erratic, similarly to Marley Spoon. This is particularly emphasised when Google’s Medic Update was being rolled out (Label M), as Dinnerly received a sudden spike in organic visibility which later settled.

A few months after the second Medic update, Google released March and June 2019 Core Algorithm Updates, resulting in Dinnerly’s organic visibility dropping by 0.0104.

Around the time this occurred, Dinnerly had few keywords ranking compared to its competitors. Dinner likely put live new content, which meant the number of keywords ranking into the top 100 continued to grow, despite being hit by the core updates.

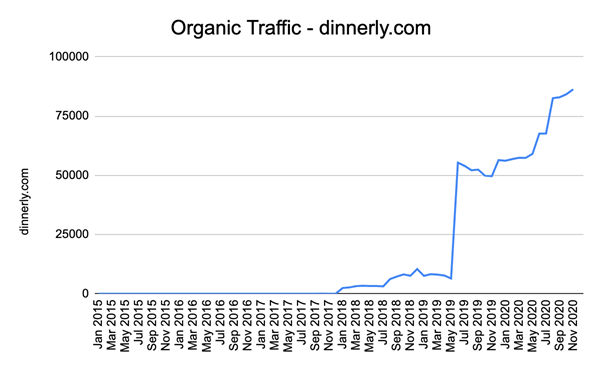

Out of the six websites we have analysed, Dinnerly is most recent to the market, with its website first receiving organic traffic in September 2017, with two sessions. But it wasn’t long until the site hit 2,000 monthly sessions in January 2018. When comparing this to Dinnerly’s competitors, the site managed to achieve much faster organic growth.

The company managed to go from the website attracting no organic traffic, to gaining over 86,000 sessions a month just 39 months later. When comparing this data to Dinnerly’s competitors, none of them has achieved organic growth as fast. Green Chef has had the second-fastest growth, but the brand achieved the same amount of sessions by month 44.

If Dinnerly’s organic traffic continues to grow at its current rate, it won’t be long before the brand has overtaken Green Chef.

Conclusion

To conclude, the US meal subscription box market has grown a lot over the past five years, and 2021 will be a critical year for Blue Apron, Freshly, and Home Chef to capture the market share Blue Apron has lost over the last couple of years.

Most of the websites analysed have been hit by at least one of Google’s Core Algorithm Updates. This goes to show that reviewing your website content and backlink profile — to ensure they are relevant and not bloated — is key. Of course, these actions go along with providing your website is ready for the May 2021 page experience update.