International SEO: what you need to know about global search engines

Over the past six months, businesses across the UK have found themselves experiencing great surges in manufacturing and exports.

The British Chambers of Commerce’s most recent quarterly survey has shown that 24 per cent of manufacturers said that their domestic sales were rising, and were at their strongest level since 2015.

What’s more, export sales were also up, with 29 per cent of manufacturers reporting growth.

To make the best of current market conditions, businesses need to start examining their websites, and potential markets, to export online.

Currently, Ireland is set to become one of the fastest growing online markets, and is to enjoy record retail sales in 2018 — but what market you decide to export online requires significant preparation.

Let’s say that you’ve identified the market(s) that you’re looking to expand into and have laid the technical foundations to do so. Now it’s time to really hone in and understand that market from the perspective of search engines.

Search engines by popularity

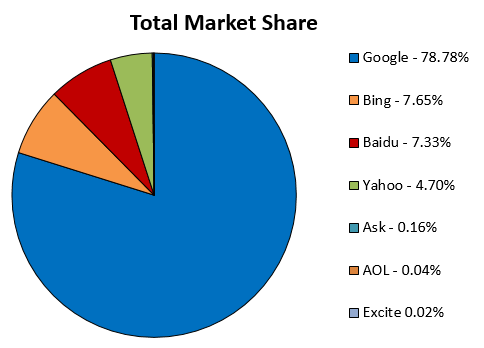

It’s easy to think that it’s all about Google, and it’s easy to forget about the importance of other search engines, especially when Google has a 78 per cent global share of all engines worldwide.

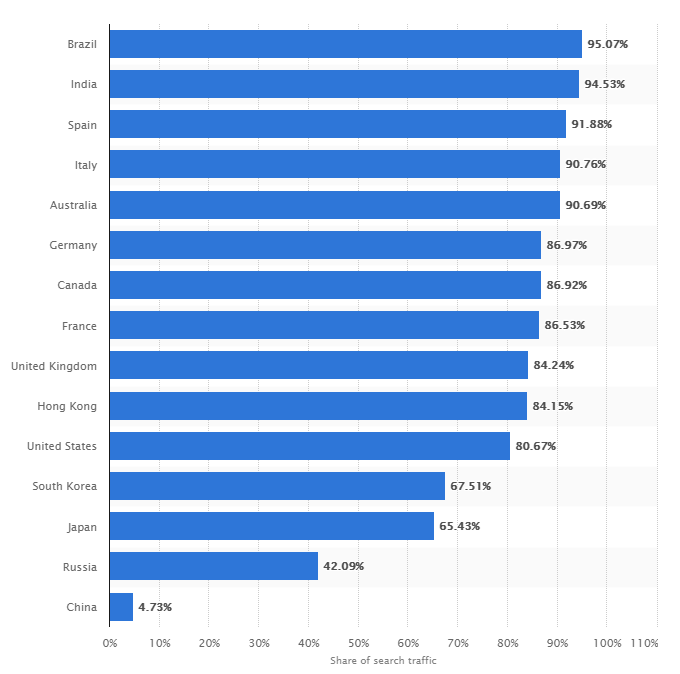

However, when we look at the search traffic originating from Google in selected countries, some countries stand out more than others:

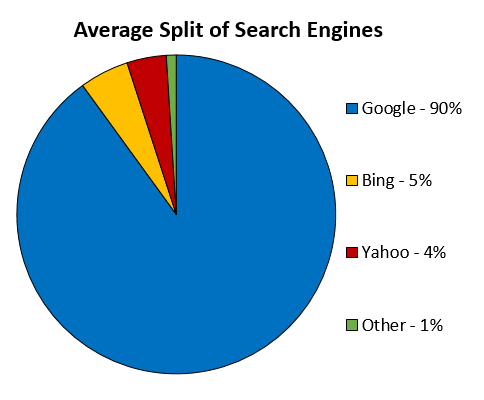

The average split of search engine market share in the first 11 countries (above) is roughly:

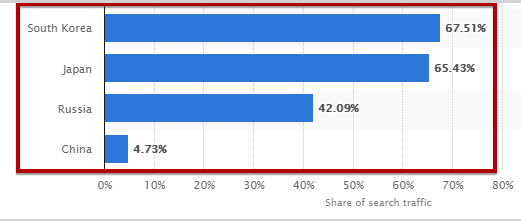

However, the interesting places to look at can be found at the bottom of the list:

There is a noticeable difference in search engine share in South Korea, Japan, Russia, and China – four affluent countries with huge export potential and massive populations, and of course their own search engines.

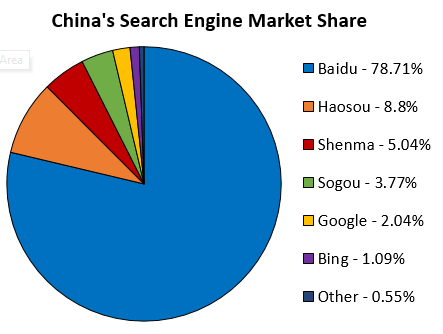

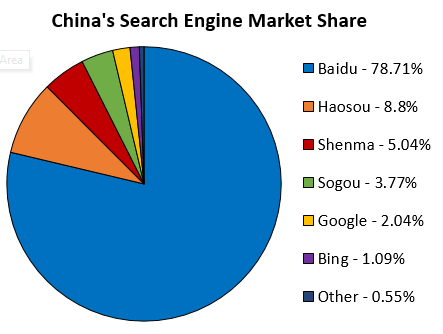

Optimising for China

Google was officially banned in China in January 2010 amid disagreements on censorship and political differences. As a direct result of this, the 36 per cent market share that it held in China was almost all swept up by China’s now leading search engine – Baidu (~420million users).

There are a few technical hurdles to jump to get into the Chinese search engine market: ideally, you’ll want a .cn domain, a hosting provider in China (or Hong Kong), a Chinese phone number, an ICP license, setup Baidu Web Master Tools, and a physical location in China.

The next task is to optimise your on-page content, and before you can begin doing this you’ll need someone fluent in Chinese that can translate your website. You also need to conduct some Chinese keyword research.

This is done the same way you’d do any keyword research, except you replace the tools you’re used to using with the Chinese equivalent. Examples include:

- Baidu’s own keyword tool Phoenix Nest (similar to Google Keyword Planner)

- Baidu’s Baidu Index (similar to Google Trends)

- Baidu top searches

- Weibo search data (for Social Media searches)

These tools should be enough to get the ball rolling.

It’s worth noting that Baidu loves meta data, and this means that special attention should be paid to optimising title tags, meta descriptions, alt-tags, & H-tags.

Like with Google, you need to make sure that all your pages are unique – this means that there is no duplicate content anywhere. Ensure that new content is added to the site as regularly as possible (this could be a weekly blog, for example).

It’s also important to realise that Baidu hates robots.txt.

Optimising for Russia

In Russia, the leading search engine is Yandex, which holds a narrow lead over Google.

Again, this is a country with a huge population, most of which does not use Google as its main search engine – a potential missed opportunity if you’re looking to export internationally from the United Kingdom.

So how do we optimise for Yandex?

SALT.agency’s Dan Taylor recently wrote a guide to Yandex Algorithms, which gives a lot of good tips on what Yandex looks for in a website (quality content, long tail keywords, localisation), and practices to avoid (intrusive pop ups, spam, PBNs & other black hat activity).

Unlike China, the strict regulations on TLDs (Top Level Domains), server hosting location, and censorship are not crucial to a successful Russian SEO campaign (but they’ll still help).

The first thing you should be looking to do is create a Yandex Web Master account and configure it to target a specific geographic location.

This is because one of the most important factors in the Yandex algorithm is localisation and creating a YWMT account will help familiarise yourself with the market.

I’d also initially recommend reading the Yandex quality guidelines (they’re very similar to Google’s).

Like with other countries and languages, keyword research should be conducted, and Yandex rewards sites that optimise their meta data – Yandex works best with Russian Cyrillic text.

Other interesting factors to note about Yandex are that it can index AJAX sites if configured correctly.

It has tested algorithms that Google has not, such as ranking websites by not using backlinks as a factor, and it’s a lot slower to crawl and (re)index websites (meaning it might take longer than usual for changes to take effect).

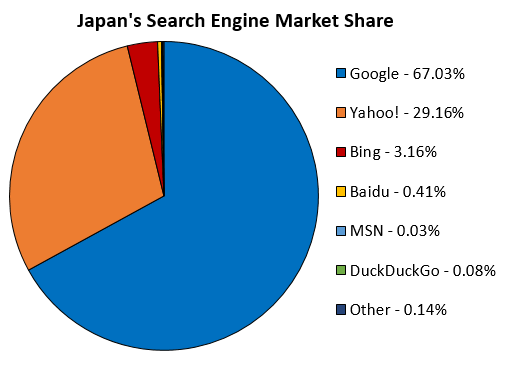

Optimising for Japan

Google has the largest search engine market share in Japan, however Yahoo! cannot be ignored with a third (roughly 38 million people) using it on a regular basis.

While Google may look the same in Japan, Japanese users have different mindsets and experience expectations, and the Google algorithm takes these into consideration.

Culturally, Japan is very different to other countries, and this is the main point of consideration when entering the Japanese search market.

“Call to search” is very prevalent in Japan – in fact, a study conducted by goo found that ~60 per cent of consumers surveyed had responded to a “call to search” CTA from a television ad, train ad or other non-online advertisements.

“Sabishii” is a concept of trust and Japanese users find low levels of content on a page untrustworthy.

Photos and design are very important, and Japanese consumers tend to be very fashion conscious, and are critical of minor details about a website’s appearance.

When it comes to writing content, it has to be emotional while searching for a connection (this concept it called “Kawaii”). This means that direct translations typically aren’t suitable, and big ‘in your face’ CTAs are not desirable to users.

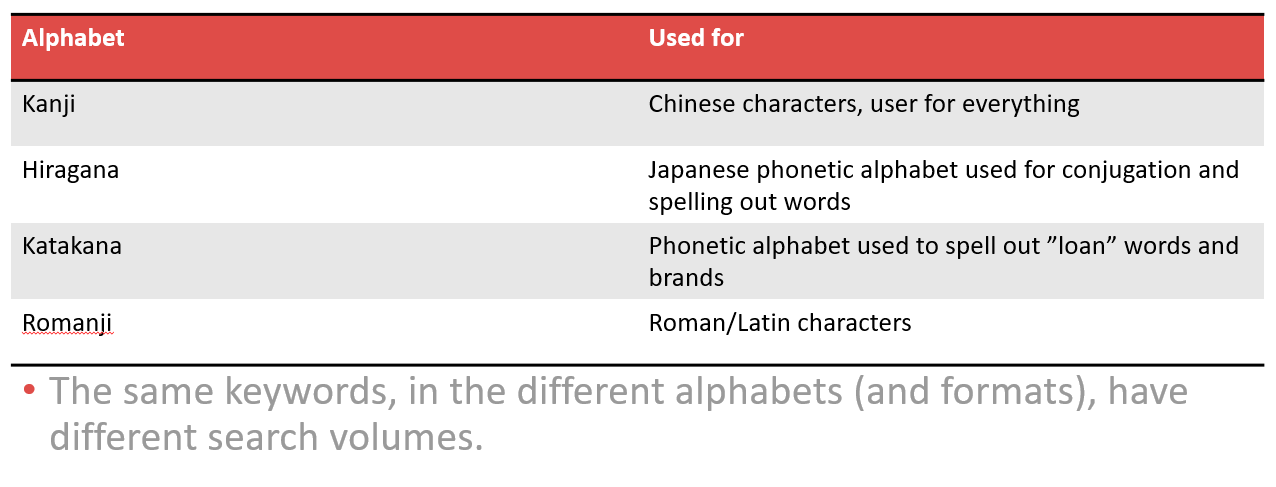

Japan has four mainstream alphabets, all of which are used differently:

Optimising for South Korea

South Korea is an especially tech-savvy market. It has already become a mobile first nation and it’s estimated that 80 per cent of the population shops online.

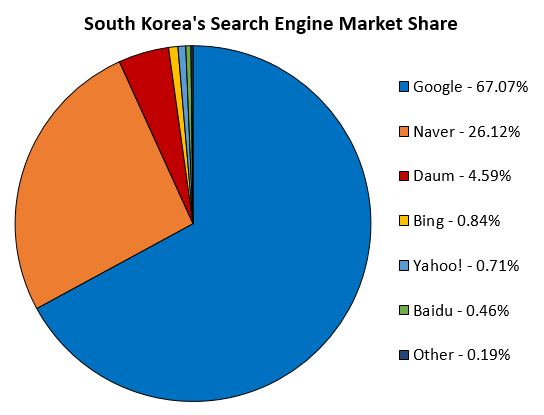

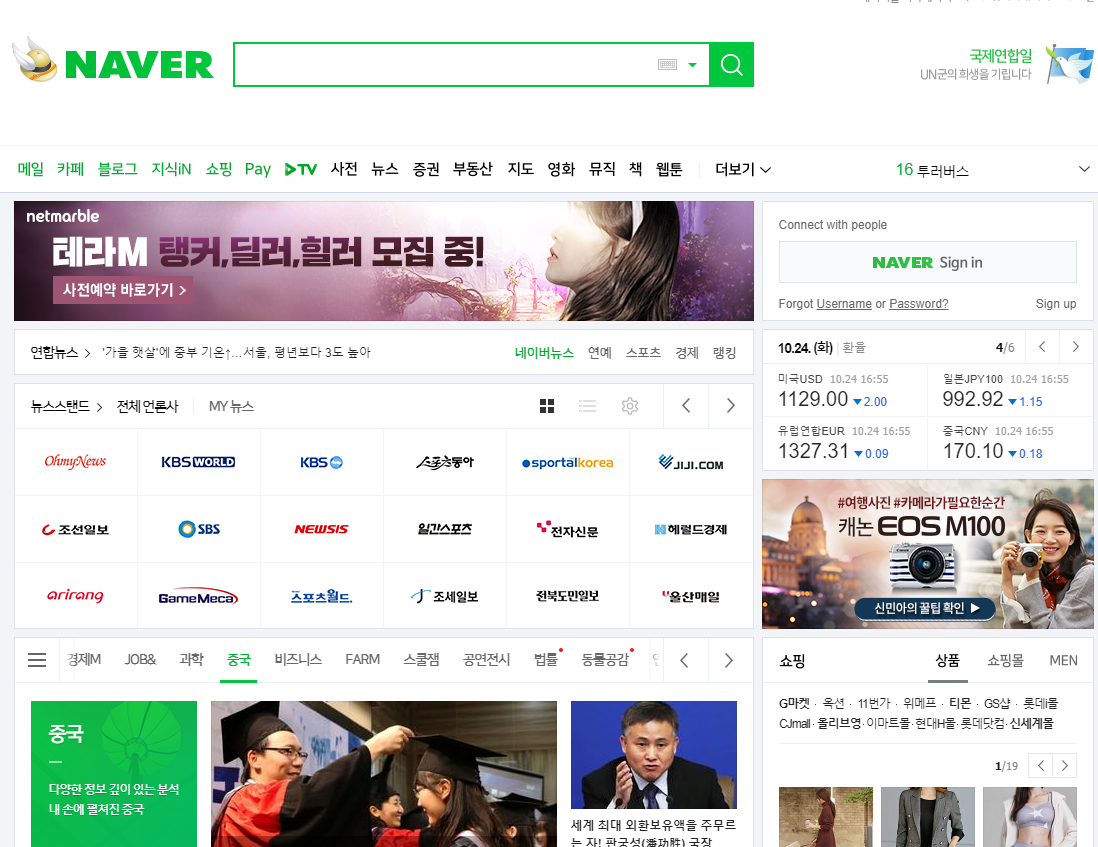

Naver is one of the leading search engines and holds a large share of the search market in South Korea, this is followed by Daum.

Naver and Daum do not aesthetically resemble search engines that we’re used to seeing. They’re flooded with content and look more like a social media hub than a search engine, this reflects the culture and as such, this should be kept in mind while optimising for South Korean search.

You need to register an account as the first port of call.

Naver can be likened to a directory type of service more than a search engine, not only because of how it looks, but because Naver doesn’t crawl all the internet, and relies on a lot of other channels to return results to users.

With this in mind, you should make yourself as visible as possible in as many channels as possible (organic, social, images, paid, Naver Encyclopedia, Naver Café – to name a few), so you have a chance of appearing in multiple areas of the SERPs.

Daum is very similar to Naver.

It has a smaller market share than Naver, so to improve this disparity, Daum approached things from new and innovate angles such as with object search, music search, barcode/QR code search, and voice search across multiple devices.

It’s important to remember that multiple channels feed into SERPs in South Korea, and sometimes you can’t even see an organic listing on the first page.

Algorithm Updates

Each one of the search engines mentioned above has their own complex algorithms that are updated regularly to ensure that users are served the most relevant results possible.

That is the main aim for all of them: to satisfy users’ search queries in the best way possible.

This means that you’ll find a lot of search engines having similar guidelines and updates to one another.

For example, all search engines are heading to the mobile first approach, they have localised search results (also known in Google as the Venice update), and all the basics such as on-page content and meta data is very important.

However, although they all have the same overarching goals, each one has its own subtle differences that should be paid close attention to when looking to venture into these markets.