Industry analysis – US Liquor Stores

Buyers are no longer depending as heavily on visiting the supermarket or convenience store to purchase alcohol. Instead, there is an increased desire to buy drinks online and avoid traveling to and from the store. Buying alcohol online saves time and makes it easier to browse the available choice of products.

We will be assessing who is shining in the US liquor store market space and which websites are not performing as well from an organic point of view. Broadly speaking, all of these websites sell spirits and liquor.

The eight eCommerce liquor store websites we evaluated are:

- Drizly

- Uptown Spirits

- Quality Liquor Stores

- CW Spirits

- Total Wine

- Bevmo

- Mission Liquor

- Liquor Store Online

Organic Traffic Overview

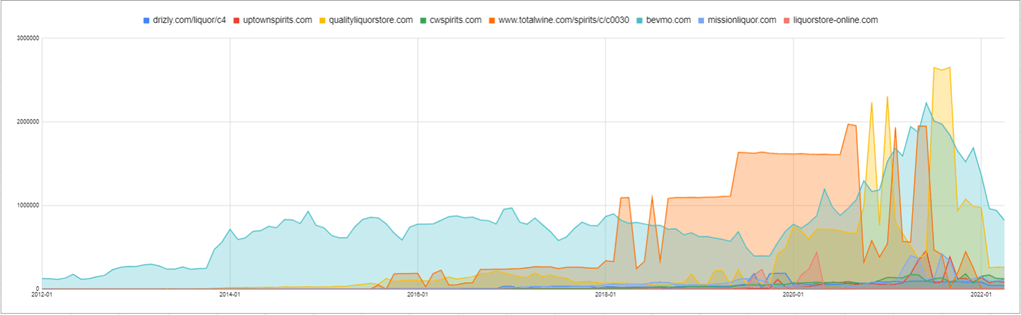

Using third-party organic visibility data from Sistrix, we have been able to compare eight leading liquor stores and their performance over the last 10 years.

Four of the eight liquor stores (Quality Liquor Stores, Bevmo, Mission Liquor, and Liquor Store Online) we have analysed were in Google’s index since 2012.

However, the other four are in Google’s index later on, with CW Spirit starting in October 2012, Drizly and Total Wine starting in late summer 2015, and Uptown Spirits starting in August 2018.

Both Total Wine and Quality Liquor Store have tried to give Bevmo keen competition, however neither have been successful. Bevmo has gradually grown their organic traffic while recovering from Google’s algorithm updates relatively quickly.

Total Wine briefly performed well for their spirit category from 2018 to 2020. However, over the past two years, their visibility in this area has dropped significantly.

Organic Traffic Leader

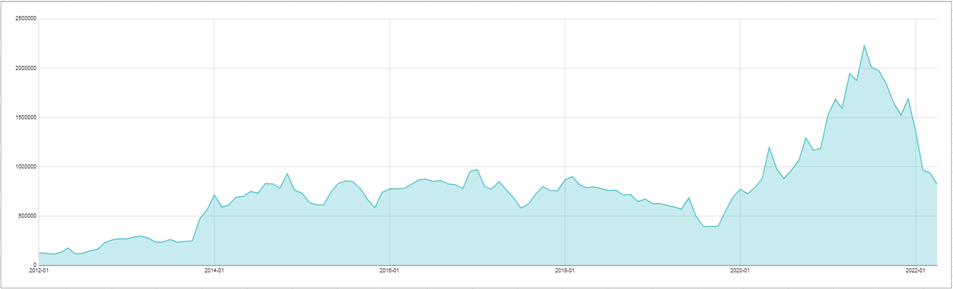

The most prominent organic traffic winner is Bevmo. Compared to the other competitors, Bevmo has had the most consistent traffic since 2012 and still obtains one of the largest amounts of traffic out of all the websites we evaluated.

Bevmo has been immensely successful organically for a number of reasons, from supporting content (related recipes) with internal links pointing back to the commercial product pages to a consistently high backlink profile. Due to the tactics used, Bevmo have exponentially increased their organic traffic by approximately 543% over the 10 years.

During Bevmo’s reign, we can see that the liquor store dip in traffic coincided with Google’s algorithm updates, but it seems their website adapted quickly to minimise any potential negative effects of these updates.

In July 2017, several SEO tools identified a substantial, though unconfirmed, Google update. According to one study, this update had the greatest impact on pages’ ranking in positions 6-10. While it affected numerous industries, the food and beverage industry was said to be the hardest hit and this correlates with a drop in traffic, reported by the third-party tools for Bevmo.

In October 2019, Google announced the BERT Update (which stands for Bidirectional Encoder Representations from Transformers), dubbing it the “largest update to Google search in the last five years.” Google will use the BERT update to better comprehend search queries. BERT will be utilised on 10% of U.S. English searches, according to Google, and will have an impact on both search ranks and featured snippets.

Bevmo’s organic market share increased dramatically, which correlates to the October 2019 BERT update. There was a negative impact on their rankings during this time, but keywords steadily came back over the festive period and into January 2020.

Overall, over the last ten years, Bevmo has developed and implemented a well thought-out and extremely effective organic approach.

Underperformer: US Liquor Store

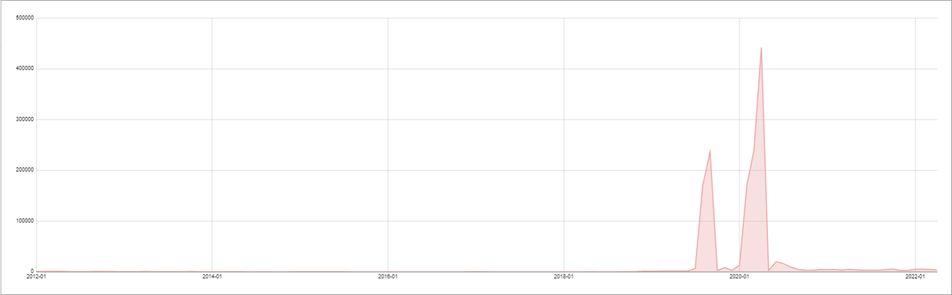

Liquor Store Online’s organic traffic is very unusual due to the sudden increase and decrease of their traffic.

In 2019, Liquor Store Online seemed to be effected by Google’s BERT Algorithm Update, due to the liquor store’s organic traffic dramatically dropping over four months. Typically, when we see a site suddenly drop month after month before stabilizing, it may suggest there were issues with the site’s overall value proposition of content. This could be because of a large proportion of keyword-stuffed content.

The purpose of Google’s Core Updates is to continuously improve the quality of search results displayed to users and provide a better experience. This is why EAT is increasingly important for the eight sites we have analysed.

Unfortunately, Liquor Store Online was negatively impacted by another of Google’s Core Algorithm Updates in January 2020, which increases speculation that the site wasn’t following SEO best practices.

Liquor Store Trends

The liquor store market fluctuates throughout the year due to seasonal trends. Here we will take a look at the main trends that affect the market.

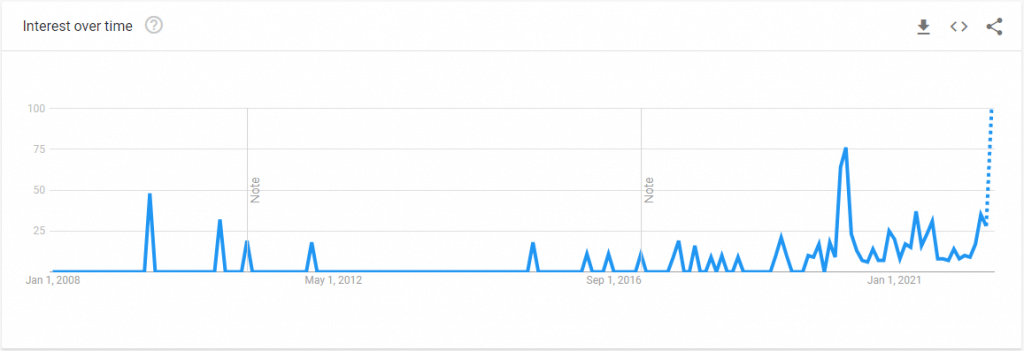

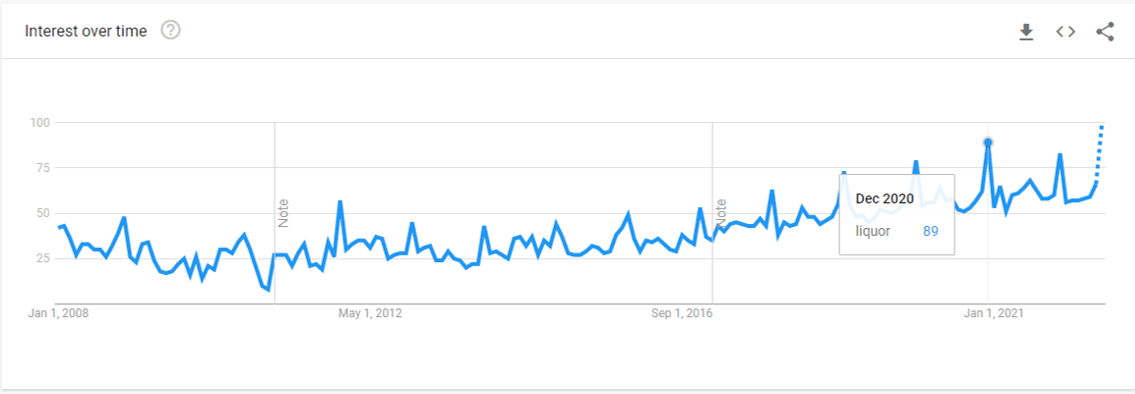

Festive Season

Google Trends shows that many are using these sites as places to find gifts or to prepare for guests for the festive period – as the key time of year seems to be consistently Christmas. As you examine the first graph above, every peak in trends correlates to the festive season, concluding that liquor stores should aim to run key marketing campaigns, offers, and deals in the lead-up to Christmas and New Year.

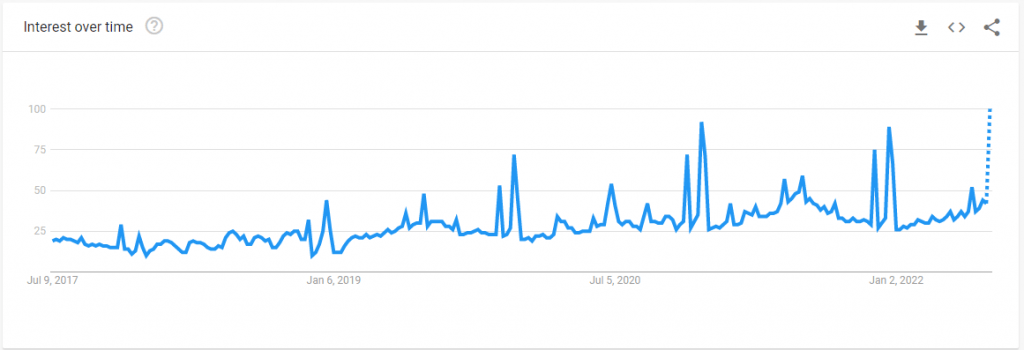

The Impact of Covid

In March 2020, there was an increased need for people to buy goods online, including alcohol. As we can examine in the graph above, there is a huge peak that correlates to the announcement of the lockdown in early 2020, which quickly dropped soon after. We have yet to see a similar spike in searches since this time as restrictions eased.

Local Terms

Over the past 5 years, we have also seen an increasing demand for local searches for liquor stores, again spiking during the festive periods. This shows the importance of local SEO for retailers with a physical store presence, either through Google My Business Listings or optimised store pages, to help drive footfall and in-store purchases.

Conclusion

The US liquor store market has developed significantly over the last 10 years, with Bevmo leading the way and little indication that other major sites will close the gap any time soon.

Unfortunately, CW Spirits, Uptown Spirits, Mission Liquor, and Liquor Store online were negatively impacted during recent years. Increasing their keyword footprint would be a great method for these businesses to grow their organic presence. This could be accomplished by selling new product lines or by using non-commercial keywords to create informative content for products that can then be connected to products internally.

Understanding why a site’s organic traffic drops dramatically is needed in reducing the risk of this happening again.